The latest residents generate home improvements and raise regional philosophy, beautify yards, boost suppress attract and, whenever residents spend money for the local locations and you can enterprises, it spend fees one to work for the new town.

Homeownership ‘s the focus away from regional U.S. economic climates, so city governing bodies enjoys bonuses and then make their avenue popular with inbound consumers.

Down payment direction programs make it possible for earliest-go out homebuyers to prevent leasing and commence running rather than saving to possess highest, 20% off repayments.

- → What’s Downpayment Guidelines?

- → How does Downpayment Guidance Performs?

- → Which Qualifies to own Down-payment Advice?

- → 5 Version of Down-payment Recommendations

- → How to find Downpayment Assistance to Purchase your Domestic

- → How much cash Do you need Having a downpayment?

- → All of our Advice: Play legit debt consolidation companies with Down-payment Assistance When it is Offered & Realistic

Deposit direction (DPA) programs are in your town-supported initiatives that give away cash gives, cheap financing, and you can taxation holidays so you can people from You.S. land.

Brand new programs is financed and administered from the regulators businesses, personal fundamentals, and local charities; and you will, offer up so you can one hundred% resource on home.

Of a lot DPA programs act like zero-interest-rates payday loans are paid off if residence is refinanced otherwise ended up selling. Other people give money to own specific aim such as for instance renovations while making residential property alot more habitable, hence brings up local possessions viewpoints and assets taxation angles.

What kind of cash you can discover from down-payment guidelines may vary considering where you happen to live, everything you secure, and just how very early you submit an application for guidelines.

Down-payment recommendations software performs by the enabling basic-time homebuyers purchase home with little to no otherwise not one of their individual currency or down-payment.

Down-payment guidelines applications are given with the federal, county, and you can regional profile. Federal DPA apps tend to be basic-big date household customer income tax credit, cash features to invest in house, and you may interest rate subsidies to have highest household affordability.

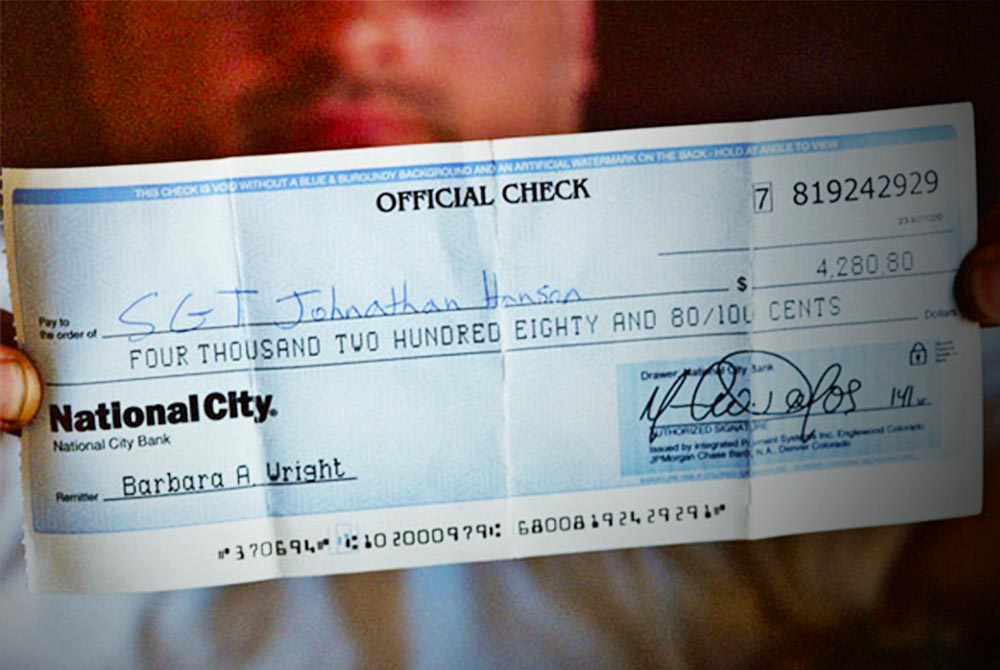

Down-payment assistance is possibly repaid since cash during the closing otherwise prior to. Some DPA apps target benefits, such teachers, nurses, and you will EMTs. Other people are available to any individual to shop for for the a particular community or path.

There are many than step 3,100000 advance payment assistance software readily available across the country and a lot of DPA software target basic-big date home buyers.

Federal DPA programs particularly Good neighbor Across the street and costs such as the $25,one hundred thousand Down-payment Toward Collateral Operate address lower- and you can middle-income earliest-time buyers and often put a couple of additional qualifications standards. Particularly, particular applications try limited to instructors and you can nurses and EMTs. Other businesses are to possess very first-generation people simply.

Toward condition and you may local levels, deposit direction programs is geography-founded and available to homebuyers only from inside the particular metropolises, groups, otherwise neighborhoods.

Non-government applications might need people to utilize specific real estate loan products eg FHA loans; and, need a lot more documentation not with the home loan app

Down payment direction programs you should never change number one mortgage loans they boost these to create homeownership less costly. Ergo, to be eligible for down payment assistance, homebuyers should also qualify for the financial.

Other times, they truly are given given that forgivable money and you can paid down in the course of closure

Dollars offers make up the majority of down-payment assistance programs. The average very first-go out household visitors dollars grant honor is approximately $10,100.

Whenever down-payment assistance is paid off as a finances grant, there is no specifications to pay they right back. not, just like the grant software are created to build people and you will promote economic increases, it’s preferred so they are able consist of a good 5-season condition one to claims your visitors need certainly to live-in the brand new home for five age and/or offer need to be repaid in the area or perhaps in full.