Articles

The study also offers multiple tall ramifications to possess health care birth. Earliest, it implies that a brief, two-question screening tool is efficiently choose customers from the greater risk for persistent requirements. It results is vital for real-globe execution, because doesn’t notably impact fulfilling minutes or workflow. Yet not, there’s guaranteeing development in regards to the monetary feasibility of do it guidance. A connected analysis by the Carr’s people learned that when healthcare team billed to own do it counseling functions, insurance agencies reimbursed these claims almost 95% of time.

MoneySense Self-help guide to the perfect Profile

You could to change the times and moments you work with, as well as the intensity of their works. This makes it easy to go with any existence, regardless of how busy you are. It’s a 9-few days system you to definitely slowly increases the number of powering you do per week, whilst adding strolling getaways. This will make it easy to follow and you may discover, even for over novices. If you’ve become contemplating powering your first 5K or if you’re also checking to have another goal to get you excited, which Sofa to help you 5K training bundle is great for assisting you to learn to defense the exact distance.

If you’re overweight ties, you then will be slim a thread holding as an alternative. A directory finance just keeps the (otherwise most) of one’s holds or securities in the a certain list. The concept would be to submit a profit most next to one of one’s complete market.

Effects out of a sedentary lifestyle

Around one to a single taxpayer produces funding growth since the one taxpayer, 50% of your own funding get is roofed on your own money, and also the almost every other 50% is income tax-totally free. Financing growth gained of one’s business try taxed an identical way. On your own firm, the brand new non-nonexempt fifty% would be decrease to your other notional membership called the Funding Dividend Account (CDA). Then you certainly have the option to pay out one balance within the the newest CDA on the investors of your own corporation for the a taxation-100 percent free base. Thankfully, within the Canada i’ve a concept named “taxation consolidation,” which helps make sure individuals are taxed likewise whether or not they receive money individually or thanks to a firm. An authorized Economic Coordinator support an excellent resigned few understand the paying possibilities, and issue, for Canadians who dedicate in to the a business.

The new depiction of one’s potato off to the right very well embodies the newest typical inactive image – yawning, ft right up, remote in hand, and scratching the lead. When you’re interested only inside passive robo management, seek out Wealthsimple, Justwealth, NestWealth, RBC Investease and you may Invisor. Almost every other Canadian robo-advisors provide different forms away from productive management. For additional info on performing probably the most tax-effective ETF Inactive portfolio, check this out blog post.

On the 3rd of about three excerpts of their the brand new publication, Restart Your own Profile, Dan Bortolotti contends one position however… To help keep your will cost you down, consider using an on-line brokerage that allow you to pick ETFs no trading income. Indexing steps are used from the most advanced pension and endowment financing executives global, and several of the supporters is actually Nobel laureates. Yet , of several financial advisors try contemptuous of your whole suggestion.

Situated in Curacao, the newest gambling enterprise also provides an extensive number of fun online game, backed by a knowledgeable games creators international. On the PlayAmo Casino you’ll manage playing the brand new the newest https://vogueplay.com/in/mermaids-pearl/ videos ports, as well as a variety of Bitcoin Black-jack, Bitcoin Poker, and you will Bitcoin Roulette online game. Along with this, the brand new casino brings a space seriously interested in Bitcoin games which happen to be provably fair. When you’re a gambling establishment no-deposit incentive is nice, we usually think a gambling website’s complete products before signing upwards.

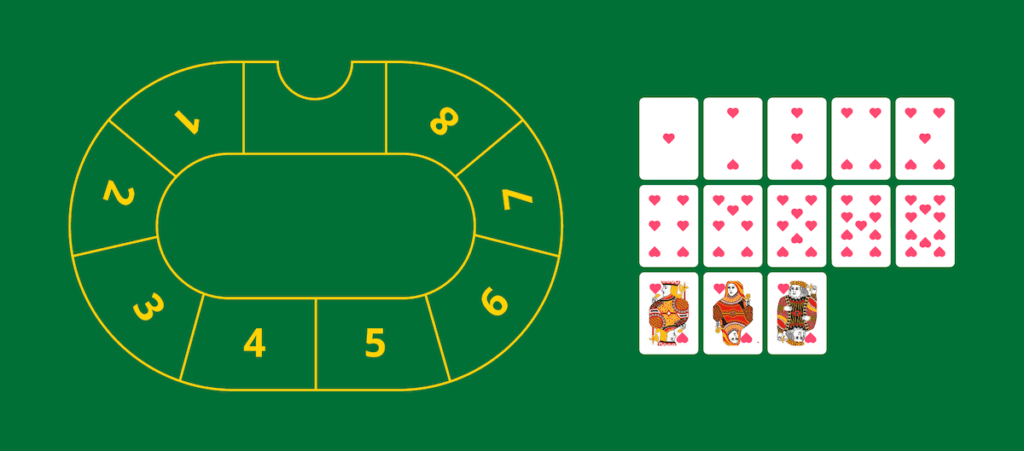

When you’re questioning what money is, it’s fundamentally a bet multiplier. Very, for those who have 3 gold coins and you are betting $5, you might be gambling a maximum of $15. Easy in the execution, even newbies are able to find Passive very easy to enjoy.

TQQQ – Would it be A good investment for a long Name Hold Strategy?

The new Margarita Portfolio is actually 33% Total United states Stock-exchange, 33% Total Around the world Stock market, and you may 34% Rising cost of living Protected Bonds. One to mistake are providing all of the idle everyone is chair carrots. If you are a passive is lazy, not all idle everyone is always settee carrots. Various other error is utilizing the definition of also broadly – simply because anyone have relaxing for the sofa sometimes doesn’t suggest it’lso are the full-fledged passive. Within the popular culture, the picture out of an inactive could have been depicted in numerous implies.

Since these bonds adult otherwise get sold, the new financing tend to bear a stable trickle of small investment loss. However, you to doesn’t indicate your investment will lose money overall, as the attention repayments regarding the securities often counterbalance no less than some the individuals losses. If the selected advantage allotment falls ranging from one of the more than options (including, 70% otherwise fifty% stocks), you might merge a just about all-security ETF with a thread ETF. In such a case, might occasionally have to rebalance your profile from the promoting a great part of one of many ETFs and buying more of the most other so you can return to your address. To several investors, the idea the Passive strategy is also defeat very elite money professionals appears ridiculous—as if someone had been offering a tennis means that will overcome really people to the PGA Concert tour.

MoneySense factor Dale Roberts are a proponent from lower-fee using, in which he has your site cutthecrapinvesting.com. See your on the Facebook @67Dodge to have business reputation and you may comments, each morning. That point out of stagflation related mainly for the 1973 petroleum drama, whenever oils nearly quadrupled in price, lasted for several years. It’s your responsibility to determine whether you desire more loyal inflation-fighters on your own collection but if which stagflationary environment you’ll persevere. Very, bear in mind, truth be told there hasn’t become a genuine sample of rising cost of living property.

Doing work as the a robust investment, the newest wild substitutes for other icons to do productive paylines when you’re giving a 5x multiplier to the wins. If a couple wilds change symbols in the a fantastic integration, the fresh payout expands to help you 25x. In spite of the laid-right back theme, Inactive proves to be fulfilling regarding gameplay. Used as the a colloquial term, they refers to somebody who may be lazy, have a tendency to just relaxing to your chair, fully entrenched in their seat.

Alternatively, we’re going to view exactly how two basic Couch potato profiles have worked for retired people – inside dollars. First-time home buyers in the Canada is remove out of deals in the inserted account to cover their downpayment. The new portfolio manager and you may podcast machine offers expertise to your benefits of getting enough time- and you will quick-term economic wants. For those who could possibly get create their particular couch potato ETF portfolio, read the MoneySense ETF Finder Device and the finest ETFs inside the Canada. The fresh BMO well-balanced design is down 5% because the January 2021, as the state-of-the-art well-balanced model is not too much behind.